Real Property Taxes in Germany 2022

Every property owner has to pay property taxes in Germany. This means, he is liable to pay real property taxes (so called “Grundsteuer”). Moreover the tax rate depends on the type of property he owns. In other words the taxes are sorted into two distinct categories.

- Real property tax “A”: Real property used for agriculture and forestry.

- Real property tax “B”: Constructible real property or real property with buildings.

Real Property Tax Rate 2022

The real property tax burden in Germany is calculated by multiplying

- the assessed value of the real property

- the real property tax rate

- the municipal multiplier

So the assessed “real property Taxes in Germany 2022” value is determined by the tax authorities according to the German Assessment Code (Bewertungsgesetz). With this in mind, the German Assessment Code refers to historical property values which are usually significantly lower than the current market value.

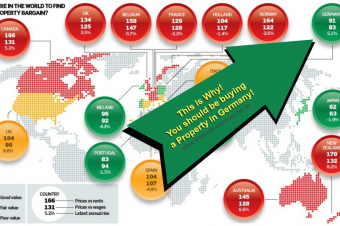

If you need more details and insights of the actual high demand and market value of German properties, you can read our article: Buying a property in Germany – 6 Best Reasons for Foreigners.

Therefore the real property tax rate depends on the type of real property. As an example the tax rate is 2.6‰ (0.26 percent) for property used for (semi-) detached houses with a value of up to EUR 60,000. Further for all remaining houses the tax is 3.5 ‰ (0.35 percent); including commercially used real property.

Therefore the real property tax rate depends on the type of real property. As an example the tax rate is 2.6‰ (0.26 percent) for property used for (semi-) detached houses with a value of up to EUR 60,000. Further for all remaining houses the tax is 3.5 ‰ (0.35 percent); including commercially used real property.

Similar to the municipal multiplier in the trade tax case, the municipal multiplier to real property tax is stipulated by each municipality separately. Consequently municipalities determine a multiplier for both real property tax “A” and real property tax “B”. Usually the rate for “B” being much higher as you can see in our list.

Determining Burden of

Property Taxes in Germany 2022

To clarify the real property tax burden for a commercial building in a municipality with an average real property tax “B” collection rate of 350 percent:

| Assessed Value | EUR 1,000,000 (e.g.) |

| x Basic property tax rate | x 0.35 percent |

| x Muncipial multiplier “B” | x 350 percent |

| = Property tax burden | = EUR 12,250 |

Real Property Transfer Tax

![]() Therefore when domestic real estate is sold or changes the owner, a one-time real property transfer tax (Grunderwerbssteuer) of the purchase price is levied. In conclusion this means, real property transfer tax is usually paid by the buyer. Above all his tax rate varies from federal state to federal state in Germany.

Therefore when domestic real estate is sold or changes the owner, a one-time real property transfer tax (Grunderwerbssteuer) of the purchase price is levied. In conclusion this means, real property transfer tax is usually paid by the buyer. Above all his tax rate varies from federal state to federal state in Germany.

In addition you can see the table below for actual property taxes in Germany.

Real Property Transfer Tax Rates in the Respective Federal States 2022

| 3.5% | Bavaria Saxony |

| 4.5% | Hamburg |

| 5.0% | Baden-Württemberg Bremen Niedersachsen Rheinland-Pfalz Saxony-Anhalt |

| 6.0% | Berlin Hessen Mecklenburg-Vorpommern |

| 6.5% | Brandenburg North Rhine-Westphalia Saarland Schleswig-Holstein Thuringia |

In addition real property transfer tax also applies to a real property-owning partnership, if 95 percent of the shareholders change within five years. After that, if you need further details on property taxes in Germany you can follow this link to a good article from Wikipedia.

Or simple get in contact with us.

Questions and Feedback

Tu sum things up, what are your questions after this article or about property taxes in Germany? What are your experiences buying a property in Germany you can share with our readers? Please leave us a comment below – we appreciate it! Tell us what you liked or even what you would like us to add to this article or our site.

Looking forward to our exchange. If you just want to be inspired by some of our reference properties we sold in Germany feel free to take a look. Inspire Me!

4 Responses

Joseph Rony

Re: Website Google Ranking

Hi,

We can fairly quickly promote your website to the top of the search rankings with no long term contracts!

We can place your website on top of the Natural Listings on Google, Yahoo and MSN. Our Search Engine Optimization team delivers more top rankings then anyone else and we can prove it. We do not use “link farms” or “black hat” methods that Google and the other search engines frown upon and can use to de-list or ban your site. The techniques are proprietary, involving some valuable closely held trade secrets. Our prices are less then half of what other companies charge.

We would be happy to send you a proposal using the top search phrases for your area of expertise. Please contact me at your convenience so we can start saving you some money.

In order for us to respond to your request for information, please include your Name, company’s website address (mandatory) and /or phone number.

Sincerely,

Joseph Rony

jospeh.rony@gmail.com

COMPLETE INTERNET MARKETING SOLUTION

SEO – PPC – SMO – Link Building – Copyright – Web Designing – PHP

Hartmut Obst

Dear Joseph,

thanks for reaching out. Please contact us via e-mail: contact@financial-services-ho.de

Regards,

Hartmut Obst

Vanessa

Thanks for your article, it’s really helpful.

I have 2 questions left:

– Can the payment of the purchase price be somehow deducted from the taxes you have to pay for owing it or from the rental income?

– how can the depreciation be calculated? Is this regulated somehow or is it an individual decision?

Thanks a lot,

Vanesa

Hartmut Obst

Dear Vanessa,

thanks for your question. If you buy a property that you want to offer for rent the answer is yes. You can deduct the interest rate and 2% per year of the sales price (without the part of the price, regarding the land) from your yearly monthly income.

Of course German law especially the tax laws are quite complex and there are many more opportunities for tax deduction during the buying process and the rental phase.

Just send us an e-mail (hartmut.obst@financial-services-ho.de) and I am happy to help. Hope we were able to provide you some useful information.

Looking forward to our exchange.

Kind regards,

Hartmut