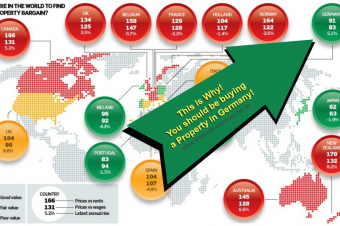

There are several reasons why more and more family offices and wealthy people consider to invest in Germany. The following article shows you what to consider if you have decided to buy a property. How to finance in Germany. If you want to know why especially properties in Germany can be an intelligent fit to your wealth management. You can check our article: Buying a Property in Germany – 6 Best Reasons for Foreigners. Let´s take a look at the right strategy on how to finance in Germany.

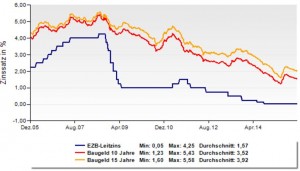

Use historically low interest rates

Mortgage lending to invest in German properties

The time is NOW. Never in history there had been interest rates as low as today. With an interest often between 1.3% and 2,0% and a house rent between 3.2% and 7.5% financing has become easy and lucrative in Germany. Even more lucrative than in most other country. The question of how to finance in Germany is nearly answered right now. This becomes clear, when you realize that you often can make up to 80% of your investment tax-deductible. As a second big plus on the list, you can use the extreme good financing conditions even if you do not need a financing today. Make a forward loan (interest rate hedging loans); in Germany this is possible up to 5 years in advance.

Check your Finances

You should cover at least the closing costs

Closing costs have increased in the last years and can be quite high on German property. As they strongly influence the way how to finance in Germany they must be considered. To give you a quick overview here are the main costs:

- Notary fees (Notar) = 2%

- Property Purchase Tax (Grunderwerbsteuer) = 3.5-6.5% dependent on area (details see Property Taxes in Germany)

- Estate Agent fees (Makler) = 3 to 6% plus VAT dependent on area, paid by the buyer of the property

German lenders like to see that you can cover at least these additional buying costs yourself. Mortgages of 100% plus the additional costs are available for real property buyers, but having these upfront costs paid by yourself upfront can significantly reduce interest on your mortgage. The discount for paying these costs can be up to 0,45% of the mortgage.

German lenders like to see that you can cover at least these additional buying costs yourself. Mortgages of 100% plus the additional costs are available for real property buyers, but having these upfront costs paid by yourself upfront can significantly reduce interest on your mortgage. The discount for paying these costs can be up to 0,45% of the mortgage.

If you buy an older property consider maintenance and renovation costs. New windows, electric wiring etc. can come up and add. If you are buying to make a profit by renting the property, you should calculate the local property prices against typical rents in the area you want to buy. This may help to calculate your profit. Always make sure you can carry all the costs even when the property is empty at any time. Of course if we help you to buy a property in Germany we make sure to do all these calculations for and with you.

Real estate as an investment

or for owner-occupiers

In times of crisis, property values have always proven to be an investment alternative. Of course, in the proper incorporation into your portfolio. Top location of the property is the prerequisite key for your long-term sustainable investment. Accordingly to this fact, it can be particularly useful to examine whether to buy a property as a conservative investment, or as an owners-occupied property. Check our article Buying a Property in Germany for more details. Often our customers buy properties in Germany as their holiday or shopping destination, what can be an affordable alternative to rent an object in the same area regularly. The concept for your mortgage can be quite different for these to scenarios.

How to finance in Germany?

Get the best Mortgage Deal!

It is wise to check out financing options as broadly as possible. Never just settle for what your own bank may offer. As your independent mortgage advisor, we will discuss with you how long you need your financing and which bank or lender offers you the best deal. 100%plus mortgages are available to German based investors. If you will use the property as a holiday destination for example this could be the case. For non-domestic buyers no more than up to 80% mortgages should be considered to get a fairly good interest.

It is wise to check out financing options as broadly as possible. Never just settle for what your own bank may offer. As your independent mortgage advisor, we will discuss with you how long you need your financing and which bank or lender offers you the best deal. 100%plus mortgages are available to German based investors. If you will use the property as a holiday destination for example this could be the case. For non-domestic buyers no more than up to 80% mortgages should be considered to get a fairly good interest.

With over 300 partners in the real estate, investment and financing business, we can do marvelous things for you. As your independent financial advisor we help you to find the perfect financing concept and the lowest interest on the market. Connect with us – We help you to make your property deal in Germany work flawless!

What to do next? Contact

Choice of Language

Let us talk – Take action today! If you can speak English or German just feel free to call us or send us an e-mail:

Russia or China: If you come from foreign countries and it is hard for you to speak German or English – Just send us an E-Mail and leave us an info. We will contact you in your native language: E-Mail with Your preferred Language! by clicking here

Questions and Feedback

What are your questions on – How to finance in Germany? What are your experiences buying a property in Germany? Please leave us a comment below – we appreciate it! Tell us what you liked or even what you would like us to add to this article or our site.

Looking forward to our Exchange and Contact. If you just want to be inspired by some of our reference properties we sold in Germany feel free to take a look. Inspire Me!

We are happy to help you to get your best personal benefits out of our contact.

6 Responses

NEVO SAMUEL PROSPER

What is the minimum amount for investing in the company and the percentage for it?

Hartmut Obst

Hi Samuel,

I do not exactly understand what you mean by your question. We are a company dedicated to helping foreigners to find the perfect investment property in Germany.

Price depends on the real estate.

If you want to be more precise we are glad if we can help you. Just send us a message to: contact@financial-services-ho.de

Regards,

Hartmut Obst

mark john

TESTIMONY :thank you for helping me getting this loan i will be for ever be grateful to you i will forever give testimony one in need of a loan to contact this loan company for help this is they direct email via(markjohnfinance@gmail.com)

Hartmut Obst

Hi Mark,

we are here to help you. Just send us an e-mail and describe your situation and where you need help.

Looking forward to our exchange.

Hartmut Obst

FactorLoads

We’re moving to Germany soon. This article gives us a lot of ideas about it. Thanks for sharing this. I’ll share this to my husband as well.

Philip

Great article. My brother is in Germany now and his planning to start a business. I think that this article will surely help him. I will share this to him. Thanks for sharing this post.